The Glue Talk Blog

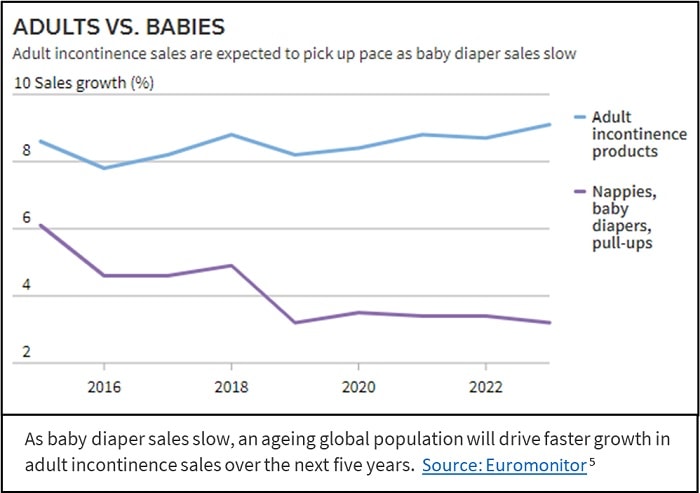

Most disposable absorbent articles can trace their humble beginnings back to the 1940s and 1950s as consumers considered, for the first time, transitioning from reusable solutions to more convenient disposable alternatives. The absorbent disposable market was born. Since that time, this market has innovated and evolved into the behemoth, global disposable hygiene market that we know today. In fact, it now exceeds $120 billion USD and is comprised of feminine hygiene, baby care, and adult incontinence absorbent article categories. While the early days of disposable hygiene consumer adoption would have seen a lot of unpredictable volatility, more recent times have experienced smoother, more predictable responses from the marketplace. However, there are two dramatic trends that are affecting the future of the baby and adult categories. And these trends are positioned to influence the space in a powerful way over the next 30 years.

The first of these trends is the decreasing birth rate, which is driving down baby diaper consumption globally. Let’s take the United States, for example. Prior to 1900, American women averaged more than seven children each. But after 1900, birth rates experienced a gradual decline – a trend that was interrupted only by the baby boom following World War II. Rates continued to decrease throughout the 1970s as women delayed marriage, had improved access to contraception, and abortion laws changed. Finally, from 2007 to 2020, the U.S. TFR dropped from 2.12 to 1.64: the lowest level ever recorded. As expected, this drop in birth rates significantly affects the consumption of diapers in the United States and growth rates of baby diapers are slowing.

But this trend extends beyond the confines of the United States to a much more global impact. In May 2021, just five years after the reversal of their one child policy to allow two children, the Chinese Government made another dramatic move. They announced that parents would be permitted to have up to three children. The driver for this positional shift is related to a phenomenon called fertility collapse. The 2021 Census data showed that China is losing roughly 400,000 people every year. This rate places China on a collision course to experience massive population decline as early as 2030. As China’s population is about 1.402 billion, based on the 2020 census, and this decline represents losing approximately half of the population or 600 and 700 million people by 2100. Responsiveness of the Chinese population to these shifting policies will greatly influence absorbent product consumption rates. As the 2016 adjustment from one to two children did not have the desired impact, it is unclear that the three-child policy will be widely embraced as the economics of a three-child, family unit can be quite costly. Consequently, diaper consumption may not increase as much as previously thought.

But this trend extends beyond the confines of the United States to a much more global impact. In May 2021, just five years after the reversal of their one child policy to allow two children, the Chinese Government made another dramatic move. They announced that parents would be permitted to have up to three children. The driver for this positional shift is related to a phenomenon called fertility collapse. The 2021 Census data showed that China is losing roughly 400,000 people every year. This rate places China on a collision course to experience massive population decline as early as 2030. As China’s population is about 1.402 billion, based on the 2020 census, and this decline represents losing approximately half of the population or 600 and 700 million people by 2100. Responsiveness of the Chinese population to these shifting policies will greatly influence absorbent product consumption rates. As the 2016 adjustment from one to two children did not have the desired impact, it is unclear that the three-child policy will be widely embraced as the economics of a three-child, family unit can be quite costly. Consequently, diaper consumption may not increase as much as previously thought.

There are certainly a few bright spots running counter to the downward trend. Emerging geographies, where birth rate decreases are not as significant, are the new baby diaper frontier. These geographies historically used non-disposable diapering solutions, as disposable offerings were considered an economic luxury. But economic changes in these geographies, such as the Middle East and Africa, are opening new opportunities for growth of disposable absorbent articles.

The second of these trends is the increase in the over 60 population, which is driving a dramatic shift in the consumption rate of adult incontinence absorbent articles. Across the globe, advances in healthcare and living conditions are shifting life expectancy into sixties and beyond. It should not be surprising, then, that every country in the world is experiencing growth in the proportion of the over 60 in their population profile. Here are some of the 60+ projections:

- 2030: One in six people in the world, or 1.4 billion

- 2050: This statistic will increase to 2.1 billion and the number of persons aged 80 years or older is expected to triple between 2020 and 2050, reaching 426 million.

While this trend will certainly start in high-income countries, it is expected that low- and middle-income countries will also be affected by population ageing. By 2050, it is estimated that two-thirds of the world’s population over 60 years will be represented by those who live in low- and middle-income countries.

As the population shifts into the over 60 range, the number of adults dealing with issues of incontinence will also grow. According to the Urology Care Foundation, as many as one in three adults—more than 80% of them women—have bladder control issues resulting from aging, health conditions, or issues with pregnancy and childbirth. Consequently, the need for adult diapers will increase accordingly. It is also expected that smart technologies for diapers will expand to keep caregivers discretely aligned with the needs of their loved one. This provides better and more personalized care that helps avoid complex, life-threatening skin infections and ulcers.

Markets will continue to shift and change with population and demographic influences. It is clear that products and raw materials aligned with baby and adult will need to be nimble and adaptive this ever-changing landscape. As product and material suppliers, we must remain diligent in anticipating the needs of both user groups and optimizing product form, fit and function through research rigor and innovation.

Blog Categories

Blog Categories

Archive

- 2024

- 2023

-

2022

- February (4)

- March (3)

- April (1)

- May (2)

- June (5)

-

August (6)

- Beverage Labeling Market In Africa: A Huge Potenial

- H.B. Fuller’s Glue House: Scavenger Hunt

- Increasing Global Aging Population: Impacts and Challenges

- Innovations and Key Challenges in Sustainable Disposable Absorbent Hygiene Products

- Supporting Racial Equity in Our Community

- Top 5 Reasons to Invest in H.B. Fuller

- September (4)

- November (2)

- December (2)

-

2021

- January (3)

-

February (7)

- Celebrating Exceptional Service During COVID-19 Complications

- Cyanoacrylates: What They Are and What They Do

- Innovative two-shot bookbinding adhesive

- Make a Difference 2020

- Problem Solving: Paper straws in drinking beverages

- Stronger straws

- Substances of Interest in Disposable Absorbent Hygiene Products

- March (4)

- April (4)

- May (4)

- June (5)

- July (2)

- August (5)

- September (2)

- October (1)

- November (3)

- December (2)

-

2020

- January (4)

- February (2)

- March (3)

- April (4)

- May (3)

-

June (7)

- Community Support in the Era of Coronavirus

- Employee Creates Face Shields with 3D Printer

- Improved Packaging Integrity and Greater Customer Satisfaction

- Liquid-Resistant Paper Straws

- What is a Sealant

- What Is the Future of Commercial Disinfectants

- Winning over consumers with e-commerce packaging solutions

-

July (6)

- Employees Take Action to be Part of Healing and Growth

- Gain a competitive advantage with packaging adhesive solutions

- HB Fuller Company Foundations Commitment to Communities

- Packaging Solutions for the South African Agriculture Market

- Supporting Organizations That Provide STEM Education for Youth

- Where Does Sustainability Stand Amid COVID-19

- August (3)

- September (2)

- October (4)

- November (2)

- December (4)